Payout And Qualified Security Incidents

When the depositor’s staked token in the Optymize Vault suffers a Security Incident accompanied with the price of that token dropping by more than a fixed percentage e.g. 50%, 75%, etc. (could also vary between different Optymize Vaults) the Security Incident will be considered qualified (“Qualified Security Incident” or “QSI”) and the depositor will receive a payout to cover her / his losses (“Payout”). Payout comprises of tokens in the Optymize Vault that did not experience a Security Incident. We aim to open the Optymize Vault on the day of the QSI and settle the Payout to depositors as soon as possible. Assume the Optymize Vault has [ETH, AVAX, MATIC, BNB and FTM] and the investment strategy is [Yearn / Convex]. If ETH experienced a QSI, ETH will be exchanged for AVAX, MATIC, BNB and FTM in the Optymize Vault. Holder of ETH will receive a basket of AVAX, MATIC, BNB and FTM after a QSI occurred and confirmed. When the depositor stakes her / his token into the Optymize Vault, Optymize will confirm the number of other tokens she / he will receive AND give, should there be a Payout. Given every depositor comes in at different times, the number of token units she/he receives and gives would dynamically reflect the prevailing token prices.

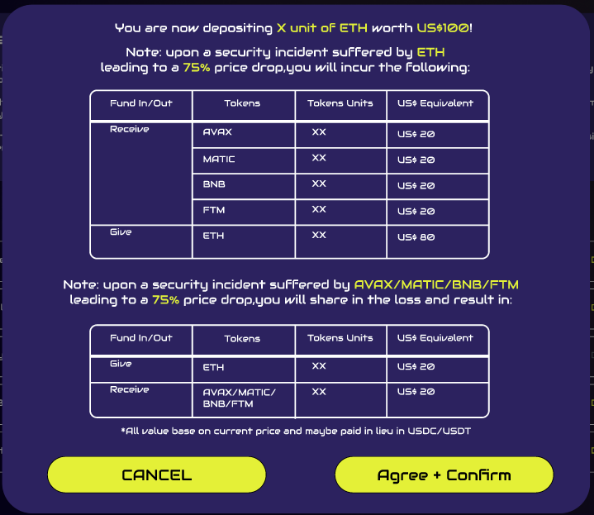

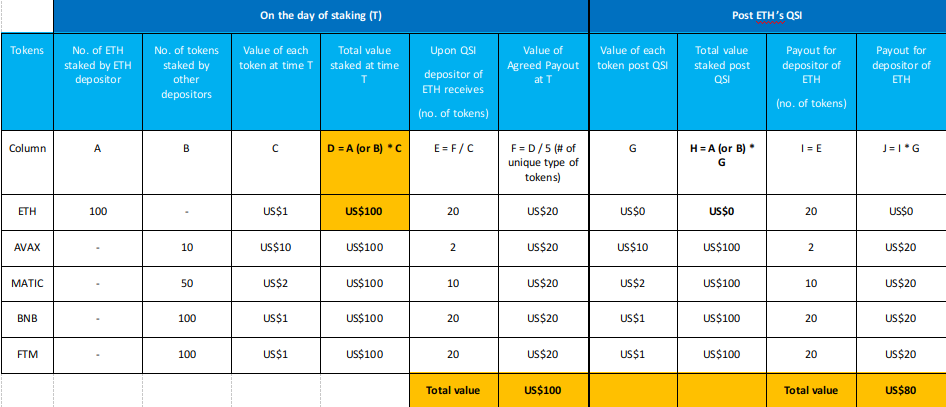

Illustration of Payout after Qualified Security Incident for ETH

From depositor of ETH’s perspective

image

In the above example, the ETH depositor has effectively swapped her / his ETH for AVAX, MATIC, BNB and FTM after the QSI occurred. The ETH depositor’s overall loss following the QSI is only US$20 rather than US$75 (75% loss) to total loss of US$100. The loss was shared by other depositors that have staked AVAX, MATIC, BNB and FTM into the Optymize Vault.

Depositors of AVAX, MATIC, BNB and FTM will swap a portion of their tokens for some of ETH. In the above example, AVAX, MATIC, BNB and FTM holders would each incur a loss of US$20 if ETH’s value ultimately drops to $0 (which might not be the case at the end). As we create Optymize Vault that allows staking of more than 5 different tokens, the loss will be shared amongst more tokens, significantly reducing the potential loss incurred by any one depositor.

Last updated